Topic

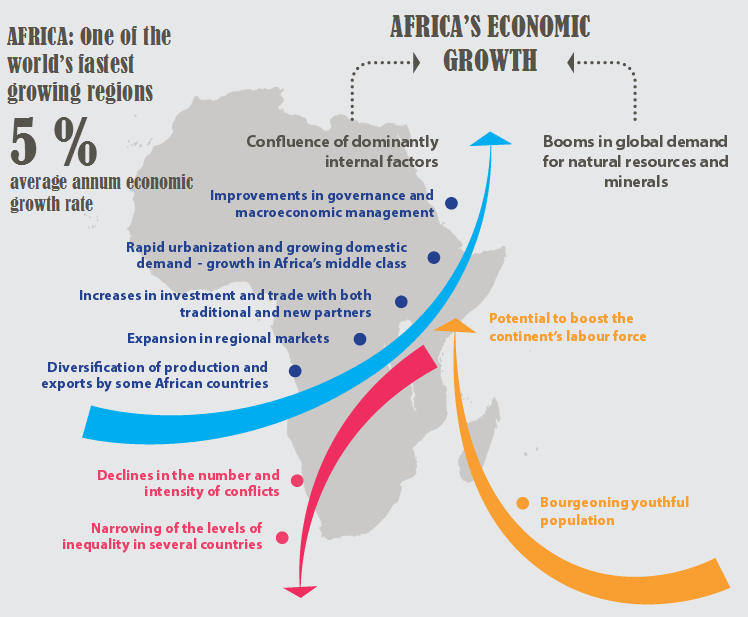

The past five years have witnessed the substantial growth and diversification of the impact investing industry in Africa. The continent is one of the world’s fastest growing regions, with abundant human and natural resources alongside domestic and international political complexity, high youth unemployment, and, recently, stagnant commodity prices. International research has consistently identified Africa as a favourite destination for capital seeking social or environmental impact.

From private equity funds targeting SMEs like Business Partners Limited and Cadiz Investments in South Africa, to the Tony Elumelu Foundation in Nigeria and the public-private Venture Capital Trust Fund in Ghana, to the Kenyan advisory firm Open Capital and Senegal’s Presidential Task Force on Impact Investing, innovation and dynamism have characterized the industry’s evolution on the continent. Specialized research units have also emerged, such as the Bertha Centre for Social Innovation and Entrepreneurship and its African Investing for Impact Barometer at the University of Cape Town, and the Centre for Impact Investing at the Ghana Institute of Management and Public Administration, as well as the CLEAR Centre on evaluation for Anglophone Africa at Wits University.

However, this growth has been uneven and slow in terms of gaining both real scale and sustainability. The largest funds still tend to be owned and controlled by American and European investors. The Northern development finance institutions have generally avoided high risk investments and have been inconsistent in measuring their additionality. Further, as elsewhere in the world, impact assessment practices in Africa are overly reliant on tracking outputs and documenting stories, placing relatively less emphasis on outcomes and impacts per se.

Moreover, there are significant differences across the various regions in the amount and type of capital being deployed, the nature and sophistication of the market, and the types of social needs for the populations that live and work in each. While East Africa continues to dominate impact investing activity, Southern Africa has also been a site of major activity, with West Africa showing strong potential and promise. The nature of impact investing in each region varies significantly in terms of the engagement of international institutions and local actors, that is, private equity investors, financial institutions, funds and development finance institutions. At the same time, each market operates in its own unique context, defined by distinct institutional capabilities and policy environments, and a range of “adjacent” efforts to promote entrepreneurship, youth employment, social development, and other state-led objectives.

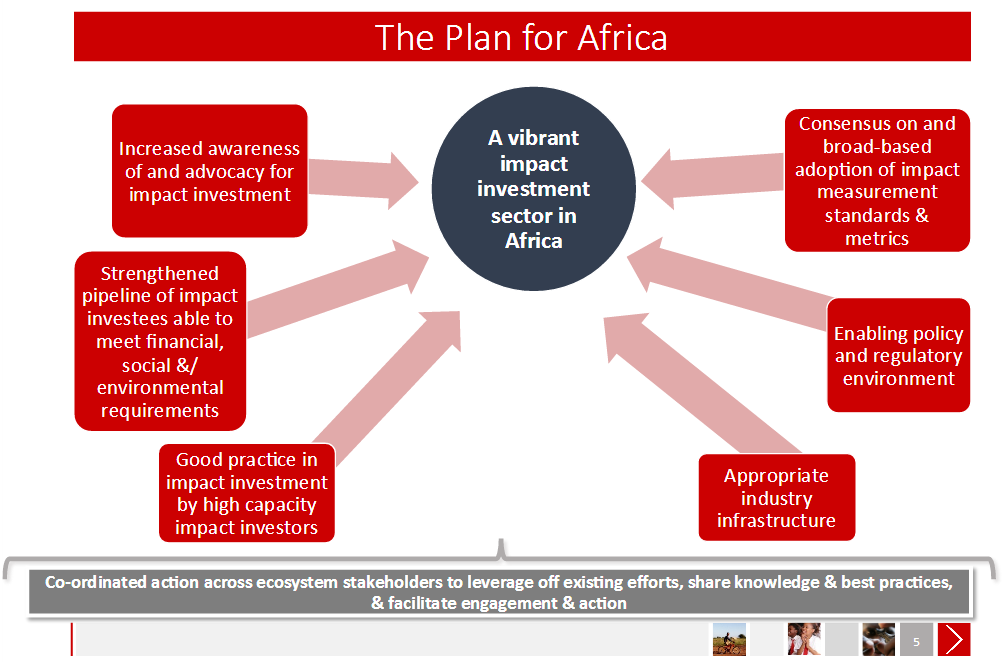

As such, impact investing operates in Africa at the intersection of traditional development assistance (bilateral and multilateral), new forms of development finance, and state-led financing for social and environmental programs. One initiative that has crystalized both the obstacles and opportunities facing the industry has been co-led by the African Union and UNDP, which together issued the 2015 Cape Town Declaration on Impact Investment in Africa. In response to the “challenges that have impeded the growth of the impact investment sector in Africa,” the Declaration called for the establishment of an Africa-wide network; the launch of dynamic advocacy program; development of a pipeline of feasible investment deals; adoption of appropriate policies and regulations; increased sector-wide capacity, including an Africa impact investment fund or fund of funds; establishment of a robust industry ecosystem; and “development and adoption of clearly defined and agreed upon impact measurement standards, monitoring and evaluation processes, and professional practice.”

Finally, in general, the launch of the Global Goals (or Sustainable Development Goals) may point the way to scaling up blended (public, private and philanthropic) financing in Africa through structured, pooled funds focused on SDG goals and targets, especially hard-asset opportunities involving renewable energy and water and sanitation infrastructure, and affordable housing.

Tools

Africa’s economic performance since the turn of the twenty-first century

Source: Hamdok 2015

Source: Mokoena 2016

Exercise

There is debate in some quarters in Africa as to what exactly constitutes an impact investment in this part of the world. Some investors take the view that, in a broad context of widespread poverty and unemployment, virtually any investment constitutes an impact investment. On the other side of the argument, other investors seek assurance that their investees target and generate benefits specifically for the poor and vulnerable within African communities. The purpose of the present exercise is to examine the different perspectives and positions in this debate. Form small groups. Choose a chair and a rapporteur for each group. Over a 30-minute session, half the room will be assigned to make the case for this statement, and the other half will be assigned to make the case against this statement: “Every investment in Africa is an impact investment.” Each group should discuss their rationale, and the implications–if any–for how to measure the impact of an impact investment. Record your answers on flip charts or slides. Your rapporteur will have five minutes to present your responses in a facilitated plenary session.

Readings

African Union and United Nations Development Program. Cape Town Declaration on Impact Investing, Cape Town, 2015. http://www.undp.org/content/dam/undp/library/corporate/Partnerships/Private%20Sector/Impact%20Investment%20in%20Africa/Cape%20Town%20Declaration%20on%20Impact%20Investment%20in%20Africa_FINAL.pdf

Bertha Centre for Social Innovation and Entrepreneurship and Skoll Centre for Social Entrepreneurship. Innovative Finance in Africa Case Studies: Exploring the emerging impact investment industry in Africa, Cape Town and Oxford, 2016. http://www.sbs.ox.ac.uk/faculty-research/skoll/our-work/research/case-studies/innovative-fihttp://www.sbs.ox.ac.uk/faculty-research/skoll/our-work/research/case-studies/innovative-finance-africanance-africa

Bouri, A. et al. Improving Livelihoods, Removing Barriers: Investing for Impact in M’Tanga Farms, Global Impact Investing Network, New York, 2011. https://thegiin.org/knowledge/publication/improving- livelihoods-removing-barriers-investing-for-impact-in-mtanga-farms

Bridges Ventures and the African Venture Capital and Private Equity Association. Investing for Impact: A Strategy of Choice for African Policymakers, London, 2014. https://www.avca-africa.org/media/1114/final-investing-for-impact-report-apr-20141.pdf

Giamporcaro, S. African Investing for Impact Barometer, Bertha Centre, Graduate Business School, University of Cape Town, Cape Town, (3), 2015. http://www.gsb.uct.ac.za/s.asp?p=499

Global Impact Investing Network and Dalberg. The Landscape for Impact Investing in West Africa: Understanding the current status, trends, opportunities, and challenges, Regional Overview, New York and Johannesburg, 2015. https://thegiin.org/assets/upload/West%20Africa/01%20West%20Africa%20Regional%20Chapter.pdf

Global Impact Investing Network and Open Capital Advisors. The Landscape for Impact Investing in Southern Africa, New York and Nairobi, 2016. https://thegiin.org/assets/documents/pub/Southern%20Africa/GIIN_SouthernAfrica.pdf

Global Impact Investing Network and Open Capital Advisors. The Landscape for Impact Investing in East Africa, New York and Nairobi, 2015. https://thegiin.org/knowledge/publication/the-landscape-for- impact-investing-in-east-africa

Hamdok, A. Innovative Financing for the Economic Transformation of Africa, United Nations Economic Commission for Africa, Addis Ababa, 2015. https://repository.uneca.org/handle/10855/22777

Harji, K. Impact Investing Worldwide: A Global Scan, Presented to the Executive Workshop on Evaluating Impact Investing: Building the Field, Measuring Success, Accra, 2016. https://etjackson.com/Harji-II-Worldwide-a-global-scan-Accra-2016.pdf

Melesse, M. Investing in Africa’s Youth, Presented to the Executive Workshop on Evaluating Impact Investing: Building the Field, Measuring Success, Accra, 2016. Evaluating Impact /Melesse Yough Employment , Accra https://etjackson.com/Melesse-Youth-Employment-Accra- 2016.pdf

Mokoena, R. Impact Investing for Africa: An Action Plan, Presented to the Executive Workshop on Evaluating Impact Investing: Building the Field, Measuring Success, Accra, 2016. etjackson.com//Mokoena-II-Africa-Accra-2016

Smith, L. Evaluating Impact Investing, Presented to the Executive Workshop on Evaluating Impact Investing: Building the Field, Measuring Success, Accra, 2016. etjackson.com/Smith-Evaluation-Accra-2016

Thornley, B. et al. The Impact Investing Working Group of the Presidential Investment Council, Senegal in Breaking the Binary: Policy Guide to Scaling Social Innovation, Schwab Foundation for Social Entrepreneurship and World Economic Forum, Geneva, 2013, 13-15. https://www.pacificcommunityventures.org/wp- content/uploads/sites/6/2015/07/PolicyGuide_to_ScalingSocial_Innovation.pdf

Thornley, B. et al. The Venture Capital Trust Fund, Ghana in Breaking the Binary: Policy Guide to Scaling Social Innovation, Schwab Foundation for Social Entrepreneurship and World Economic Forum, Geneva, 2013, 28-30. https://www.pacificcommunityventures.org/wp- content/uploads/sites/6/2015/07/PolicyGuide_to_ScalingSocial_Innovation.pdf

United Nations Development Program. Impact Investing in Africa: Trends, Constraints and Opportunities, New York, 2015. http://www.undp.org/content/dam/undp/library/corporate/Partnerships/Private Sector/Impact Investment in Africa/Impact Investment in Africa_Trends, Constraints and Opportunities.pdf