Topic

Impact investment funds are one of the fastest growing and most visible components of the impact investing sector, especially across Africa. Impact funds are an important channel through which impact investors make investments. Funds typically pool capital from a number of investors (called limited partners, or LPs) that are under the stewardship of the fund manager (called a general partner, or GP), who targets a specific risk-adjusted return as well as impact return. The GP is responsible for allocating this capital among a portfolio of companies, which they will actively source and select, based on their due diligence, and provide with financial investments as well as non-financial value added services (such as connections to potential markets or suppliers, etc.). The fund manager is then expected to use a range of strategies to realize the targeted financial and impact returns over the term of the fund.

These impact investment funds vary greatly in their focus, approach, structure and results. For example, some funds only make debt investments and others only make equity investments, but examples exist where funds make both types of investments. Some funds focus on specific sectors like microfinance or education, while others can be multi-sector in scope. In terms of geography, some funds are focused on a particular region or regions. Moreover, some impact funds focus on specific stages in the investee lifecycle, such as early-stage or growth, while other funds focus on multiple stages through follow-on financing arrangements. This may be, but is not always, commensurate with the level of risk that the fund is willing to take on. As well, some funds actively contribute to field-building and ecosystem development in addition to their core portfolio management functions.

Assessing impact funds is crucial because there are important distinctions from how investees or enterprises are assessed. One notable difference is that the fund represents a portfolio of investees rather than a single investee, and assessment of social impact is likely to take place at both the level of the individual investee as well as at the aggregated portfolio level. This raises a range of issues related to measurement; for example, assessing what specific outputs and outcomes can be attributed to the individual fund manager, based on their financial investment as well as their non-financial “value add”. Impact funds also typically have an investment thesis or theory of change that explains their intended impact and relates this to the types of investments they seek to make. As such, assessment of impact funds is a multi-faceted exercise.

Cases

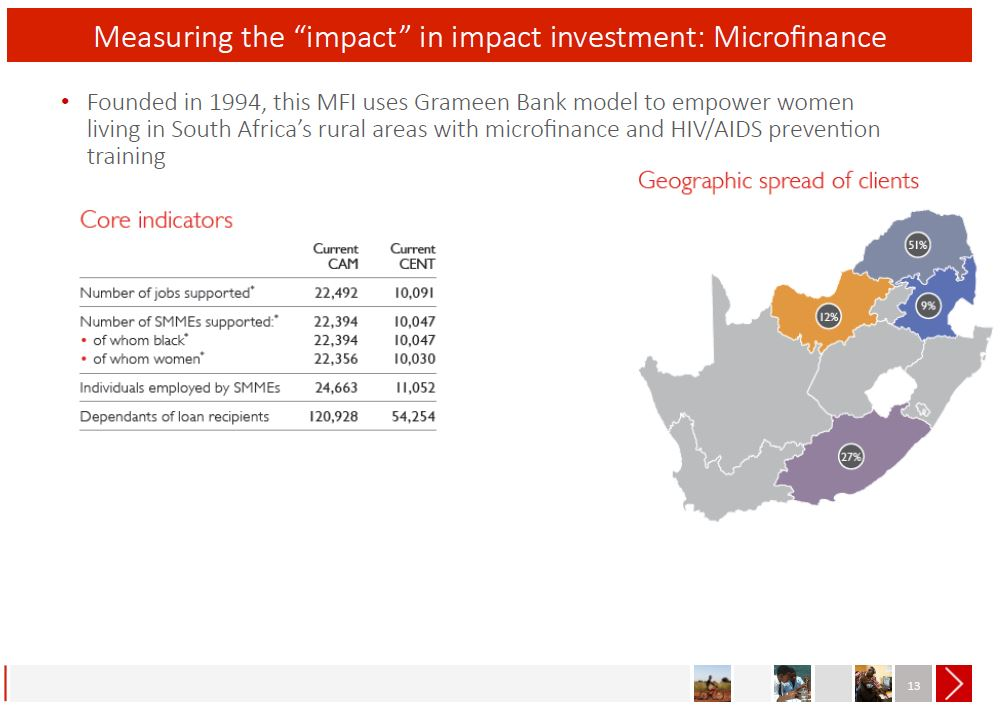

GreaterCapital is a Cape Town-based social enterprise providing consulting services in impact investing, corporate social investment, and the civil society sector that is linked to GreaterGood, a charitable trust, and affiliated with the African Management Services Company (AMSCO). GreaterCapital has worked with Cadiz Investments to assess the social performance of the Cadiz High Impact Fund and the Cadiz Enterprise Development Fund. The High Impact Fund invests in affordable housing, transportation and SME finance, while the Enterprise Development Fund prioritizes affordable housing, microfinance, ICT and SME finance.

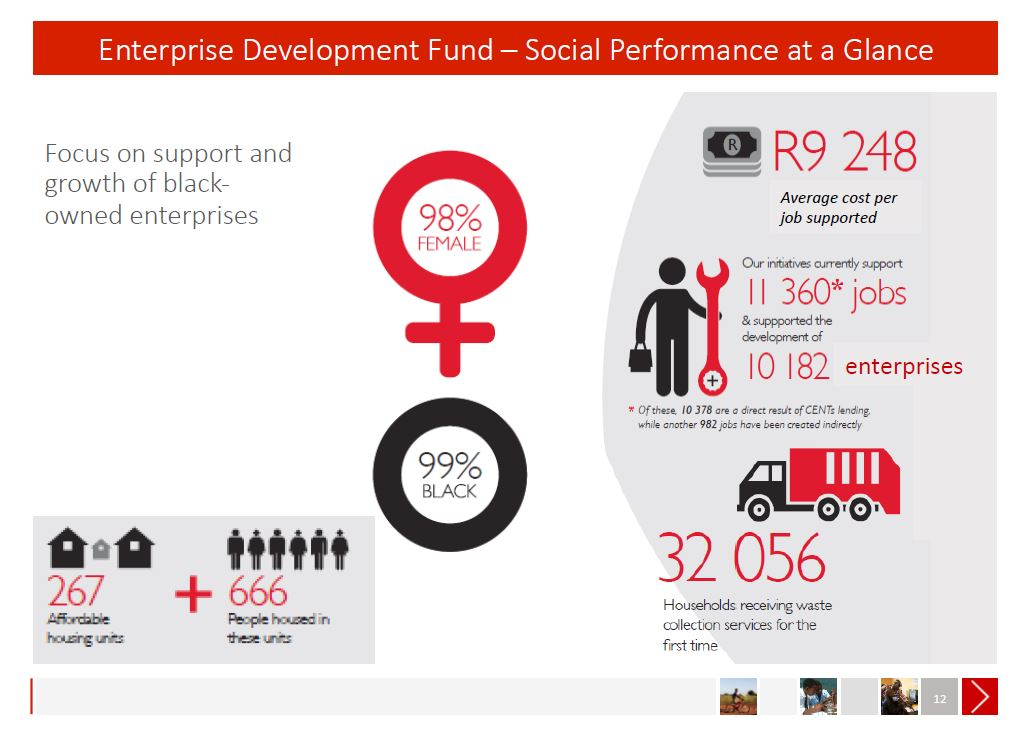

The priorities of these funds are aligned with the Sustainable Development Goals and South Africa’s national development plans. Accordingly, in the case of the Enterprise Development Fund, GreaterGood helps Cadiz track key metrics for the number of Black-owned businesses supported, number of women-owned businesses, numbers of jobs and businesses supported, and number of households receiving key services (e.g., waste management).

In playing this role, GreaterCapital has learned that: the intentions of both the investor and investee inform the indicators that are selected for evaluation and monitoring; social performance targets and their means of verification should be reflected in investment agreements; standardized indicators are desirable to the extent they are appropriate; there should be a distinction among outputs, outcomes and impact; there are costs and it should be clear who pays for what components of the assessment process; and feedback loops for continuous improvement by the fund and investees are key in the assessment process, as well.

This experience has also underscored the importance of tracking social impact in order to: unlock new sources of capital, learn and improve investment processes, differentiating your fund for investors, and meeting the accountability requirements of investors, boards of directors, and governments, among others. For fund assessment, one lesson is the importance of the parties to the transaction to ensure that social reporting metrics and protocols are explicitly structured into the terms of the investment deal. There are tools developed by major development finance institutions for integrating environmental, social and governance indicators into front-end due diligence of prospective investments, along with the Impact Reporting and Investment Standards (IRIS) and the Global Impact Investing Rating System (GIIRS).

Source: Mokoena 2016

Source: Mokoena 2016

Exercise

Take 15 minutes to read the case and presentations of Mokoena and Edwards on the work of GreaterCapital and Cadiz. In plenary, prepare your answers to the following questions: What, in your view, are the strengths and weaknesses of this approach to fund impact assessment? What would you anticipate to be the biggest obstacles to collecting and analyzing useful data on the social performance of investees? How would you address those obstacles? A facilitated plenary discussion will provide the forum for your responses.

Readings

Edwards, D. Quantifying Impact for Investors, Presented to the Executive Workshop on Evaluating Impact Investing Entitled Building the Field, Measuring Success, CLEAR Centre for Anglophone Africa and the Rockefeller Foundation, Johannesburg, 2015. etjackson.com/Edwards-Wits-CLEAR-workshop-October2015.pdf

Global Impact Investing Network. Assessing Impact Strategy: A supplemental resource for impact investors, Discussion Guide, ImpactBase, No Date.

Mokoena, R. Social Performance of Cadiz Fund, Presented to the Executive Workshop on Evaluating Impact Investing Entitled Building the Field, Measuring Success, CLEAR Centre for Anglophone Africa, Venture Capital Trust Fund, GIMPA Centre for Impact Investing, Institute for Policy Alternatives, International Development Research Centre, and the Rockefeller Foundation, Accra, 2016. etjackson.com/Mokoena-Social-Performance-Accra-2016.pdf

Sarona. Growth that Matters: Annual Values Report 2016, 2016. http://www.saronafund.com/user-files/uploads/2016/07/2016-Values-Report-FINAL.pdf.

Schweer Rayner, C. Impact Investing Fund Manager Profiles, University of Oxford, Skoll Centre for Social Entrepreneurship, 2015. /Fund-Manager-Profiles-Compiled.pdf

Schweer Rayner, C. A Tale of Two Agricultural Funds, University of Oxford, Skoll Centre for Social Entrepreneurship, 2015. Evaluating-Agricultural-Funds-Case.pdf