Topic

As a result of creative and disciplined work in a variety of fields and organizational settings, there are several sets of standards that can and should be applied in the evaluation of impact investing programs, funds and individual investments.

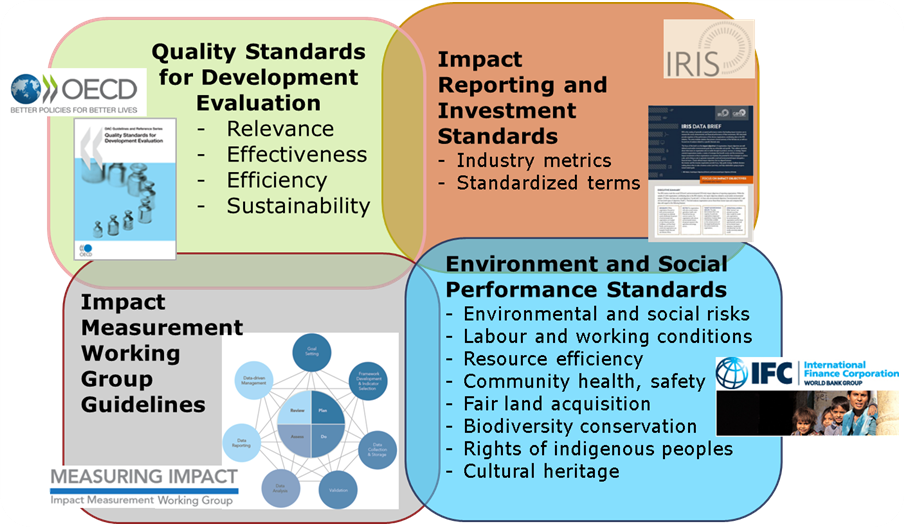

The OECD has published a set of quality standards for development evaluation—focused on relevance, effectiveness, efficiency and sustainability—that development agencies have been using for many years. The International Finance Corporation has promoted a set of Environmental and Social Performance Standards for investments in private companies in developing economies; a number of Northern DFIs apply these standards in their deal selection, monitoring and reporting.

In the impact investing industry, there has been nearly a decade of work on the Impact Reporting and Investment Standards that define common industry metrics and standardized terms. In addition, the Impact Measurement Working Group on the 2014 G8 Task Force on Social Impact Investment highlights the impact value chain as a common theory of change for the field, and proposes a set of activities for assessing the social impact of impact capital.

All of these standards, and others, have strengths and weaknesses. But there are two outstanding issues. First, these standards have not been integrated and so remain fragmented in their practical application. And second, some of these standards are expensive and time-consuming to apply. They thus require a subsidy to implement. Perhaps more important, however, is the fact that none of these standards is home-grown in Africa. What kind of standards, it may be asked, does Africa want?

Tools

Setting Standards for Evaluating Impact Investing

Source: E.T. Jackson and Associates Ltd. 2016

Exercise

Form small groups and choose a chair and rapporteur for each. You have 30 minutes for this exercise. Review the elements of each of the sets of standards. The core question for your group is: For African stakeholders, what kind of standards for evaluating impact investing are needed in your country? Are new standards needed or can you adapt existing sets of standards? What is unique and different about the standards that are needed for Africa? What is not different? Record your responses. Your rapporteur will have five minutes to present your group’s responses to a facilitated plenary session.

Readings

BAnalytics. Case Studies, No Date. http://b-analytics.net/customers/case-studies

Development Assistance Committee. Quality Guidelines for Development Evaluation, Organisation for Economic Cooperation and Development, Paris, 2010. https://www.oecd.org/development/evaluation/qualitystandards.pdf

Donor Committee on Enterprise Development. Measuring Results and the DCED Standard, Oxford, 2016. http://www.enterprise-development.org/measuring-results-the-dced-standard/

Global Impact Investing Network. Impact Reporting and Investment Standards, New York, No Date. https://iris.thegiin.org/

Impact Measurement Working Group. Measuring Impact: Subject paper of the Impact Measurement Working Group, G8 Social Impact Investment Task Force, London, 2014. http://www.evaluatingimpactinvesting.org/wp-content/uploads/Measuring-Impact-IMWG-paper.pdf

Impact Reporting and Investment Standards. Data Driven: A Performance Analysis for the Impact Investing Industry, New York, 2011. https://iris.thegiin.org/document/data-driven-a-performance-analysis-for-the-impact-investing-industry/

International Finance Corporation. Environmental and Social Performance Standards and Guidelines, Website: http://www.ifc.org/wps/wcm/connect/topics_ext_content/ifc_external_corporate_site/ifc+sustainability/our+approach/risk+management/performance+standards/environmental+and+social+performance+standards+and+guidance+notes

Jackson, E. and K. Harji. Setting Standards in Evaluating Impact Investing: What Does Africa Want? Evaluation for Africa, March 29, 2016. http://africaevaluation.org/Africa/2016/03/29/setting-standards-evaluating-impact-investing-africa/