Topic

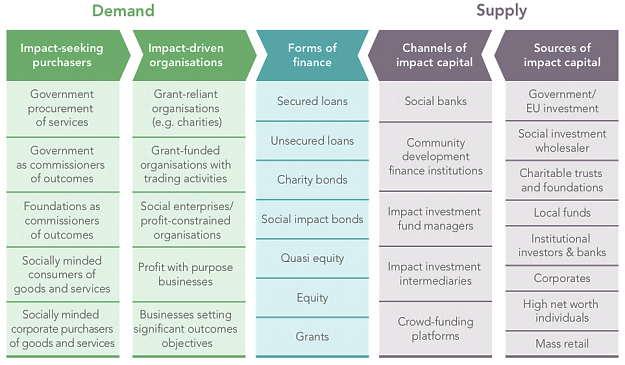

The impact investing ecosystem comprises at least four components: the demand for capital, the supply of capital, the intermediaries and channels that connect the two, and the broader context within which all actors operate. The demand side includes a range of organizations that “put capital to work” to generate financial returns and social impact. The supply side includes the range of asset owners and asset managers that are actively making investments decisions, using a variety of forms of finance, which is deployed through a range of channels. All these actors typically operate within a wider policy and regulatory structure that spans capital markets, economic development, social development, as well as sector-, issue- and population-specific focus. As well, markets operate within an evolving set of political, social and cultural norms and conventions.

Source: G8 Social Impact Investing Task Force 2014

While there has been some notable progress in beginning the process of building national ecosystems in Africa, there are four challenges that must be addressed in a forthright and creative fashion. First, these ecosystems are, so far, too small and fragile. In many countries, an established practice of private equity of venture capital does not yet exist, and often only an early set of experiences with investee pipeline development for social enterprises. Existing and prospective investors and funders must come together to accelerate their growth.

Second, notwithstanding some impressive exceptions, African-owned funds, in particular, are also too small—and too few in number relative to funds owned by and based in the Global North, no matter how progressive or effective the latter may be. This issue requires serious attention, but, especially with the launch of the Sustainable Development Goals, and their clear, thematic focus, building a robust network of large, African owned impact funds over the next 15 years should be quite possible.

Third, the policy environment within which impact investing industry actors operate remains underdeveloped in Africa (as well as many other countries). To be sure, there are interesting precedents which can be refined and replicated, such as SME support in Senegal, public-private collaboration in venture capital in Ghana, and Kenya’s Microfinance Act. But there is insufficient research and education across the continent on the policy agenda.

Finally, young African professionals need to see a viable path in impact investing and innovative finance on which they can build productive and rewarding careers and, at the same time, sustain their families.

While these challenges are formidable, much is known about how to build vibrant, resilient networks and industries. Moreover, it is increasingly clear that disciplined and transparent evaluation and monitoring of funds and investments can help build high performing national impact investing industries.

Cases

South Africa and Ghana provide two different sets of ecosystem challenges and opportunities. With its highly developed financial and industrial sectors, and extensive activity on responsible investing and corporate community investment, South Africa has seen the development of leading-edge impact funds like Business Partners Limited and Cadiz Investments as well research and training of fund managers by the Bertha Centre at the University of Cape Town. However, the impact investing ecosystem remains fragile and fragmented, though the Southern African Impact Investing Network, animated by the firm GreaterCapital, aims to address these issues and build new networks elsewhere in southern Africa. For its part, Ghana faces the challenges associated with small financial and industrial sectors and a smaller economy overall. Nonetheless, a diverse group of stakeholders are active in the impact investing space, including private equity funds like the Oasis Fund, foreign DFIs, non-profits and foundations, policy makers and researchers. One of the key players in the effort to build impact investing in Ghana and across West Africa is the Venture Capital Trust Fund, a public-private partnership that targets SMEs and has expertise in angel investing, as well.

Exercise

Form small groups; each choose a chair and a rapporteur. The instructor will assign the case of South Africa to half of the groups and the case of Ghana to the other half. Over a 30-minute session, the groups are asked to answer the following questions: Overall, what are the priorities for building a national ecosystem in the impact investing industry that will be robust, scaled and sustainable? What resources are needed, from which actors, to address these priorities over the next five to ten years? Finally, how can industry leaders build a career path into this ecosystem for young local professionals in business, finance, public policy and development? Record your answers on flip charts or slides. Your rapporteur will have five minutes to present your responses in a facilitated plenary session.

Readings

Bouri, A. A Coming of Age for Impact Investing, Sanford Social Innovation Review, August 2015. http://ssir.org/articles/entry/a_coming_of_age_for_impact_investing

Clark, C. and B. Thornley. Cracking the Code of Impact Investing, Sanford Social Innovation Review, July 2016. http://ssir.org/articles/entry/cracking_the_code_of_impact_investing

Gachin, J. Kenya tops EA bloc in impact investments, TrademarkEA Reprint from August 10, 2015. https://www.trademarkea.com/news/kenya-tops-ea-bloc-in-impact-investments/

Global Impact Investing Network and Dalberg. The Landscape for Impact Investing in West Africa: Understanding the current status, trends, opportunities, and challenges, Regional Overview, 2015. https://thegiin.org/assets/upload/West%20Africa/01%20West%20Africa%20Regional%20Chapter.pdf

Global Impact Investing Network and Open Capital Advisors. The Landscape for Impact Investing in Southern Africa, GIIN, February 2016. https://thegiin.org/assets/documents/pub/Southern%20Africa/GIIN_SouthernAfrica.pdf

Global Impact Investing Network and Open Capital Advisors. The Landscape for Impact Investing in East Africa, GIIN and Open Capital Advisors, July 2015. https://thegiin.org/knowledge/publication/the-landscape-for-impact-investing-in-east-africa

Harji, K. Mainstreaming Impact Investing, Pulse, October 10, 2016. evaluatingimpactinvesting.org/Mainstreaming-Impact-Investing-KH.pdf

Harji, K. and E.T. Jackson. Accelerating Impact: Achievements, Challenges and What’s Next in Building the Impact Investing Industry, Rockefeller Foundation, New York, 2012. Accelerating-Impact-2012 full report

Jackson, E. Sovereign Wealth: Two ways African governments can hold DFIs accountable, Evaluation for Africa, April 26, 2016. http://africaevaluation.org/Africa/2016/04/26/sovereign-wealth/

Jackson, E.T. and K. Harji. Field-Building for Resilience: Ten Tactics for the Impact Investing Industry, Evaluation Office, Rockefeller Foundation, New York, 2013, 4p. Field-Building-Ten-Tackticks-Rockefeller.pdf

Koenig, A. and E.T. Jackson. Field-building: the cases of Ghana and South Africa, Annex K in Private Capital for Sustainable Development, Danida Evaluation Department, Copenhagen, 2016. http://web.archive.org/web/20160814170448/http://um.dk:80/en/danida-en/results/eval/Eval_reports/evaluation-studies/publicationdisplaypage/?publicationID=E15693B2-6449-4AB1-A33A-BC8BE0067D42

Mack, K., SJ. Lu, L. Vaidyanathan, S. Gopal and M. Lisak. Evaluating Ecosystem Investments, FSG, No Date. http://www.fsg.org/publications/evaluating-ecosystem-investments

Nicholls, A. The Landscape of Social Impact Investment Research: Trends and Opportunities, MacArthur Foundation and the Said Business School, University of Oxford, Oxford, 2016. https://thegiin.org/research/publication/oxford-reviews-global-data,-literature-on-impact-investment-research

Thornley, B., D. Wood and K. Grace. Impact Investing: A Framework for Policy Design and Analysis, PCV Insight, San Francisco and Institute for Responsible Investment, Harvard University, Cambridge, 2011. http://iri.hks.harvard.edu/files/iri/files/impact-investing-policy-framework.pdf