Topic

Underlying every impact investment is a theory of change, either explicit or implicit. By mobilizing and deploying their capital, and monitoring it as it travels to its investee business and then onward to the investment’s beneficiaries, the impact investor expects certain economic, social or environmental, and financial, results to be achieved. Indeed, the investor raises funds precisely on the basis of these expected results.

As Morra Imas and Rist note, a theory of change is a model that specifies, usually visually, the underlying logic, assumptions, influences, causal linkages and expected outcomes of a program or project. Through the collection and analysis of quantitative and qualitative data, this model can be tested against the actual process experienced and results attained by the intervention. It also can be compared against the theories of change of other models.

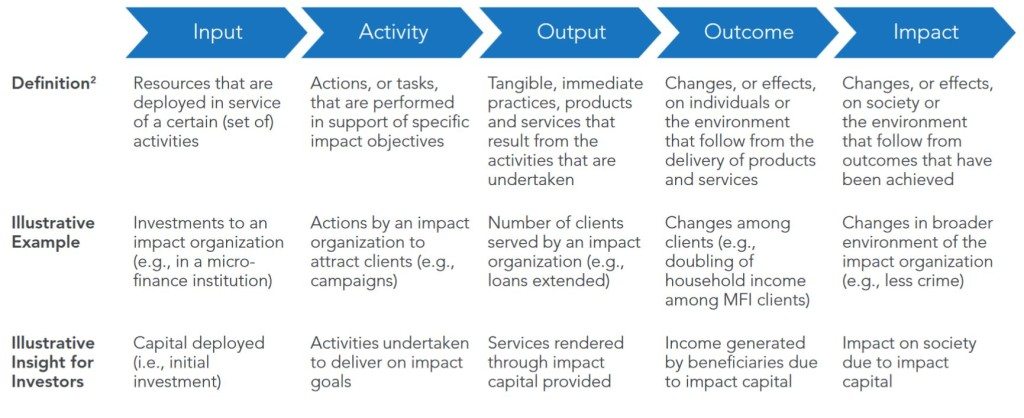

Evaluation and monitoring can be used to interrogate the theory of change critically, to assess its appropriateness, relevance, validity and accuracy, and to strengthen it—or discard and change it. The Impact Measurement Working Group of the G8 Social Impact Investment Task Force has proposed a general logic model, entitled the Impact Value Chain, to depict the logic, flow and types of results expected for the impact investment process. A complex, multi-level, theory of change was developed to evaluate the Rockefeller Foundation’s Impact Investing Initiative. Most impact investment funds provide prospective investors and investees with an explicit theory of change, or investment strategy, against which their performance can be assessed. This assessment can be made at the level of the individual investment or at the level of the fund’s portfolio as a whole.

Theory of change analysis can be employed in combination with other development evaluation strategies, such as utilization-focused, developmental or participatory evaluation to carry out more systematic assessments. In a more participatory approach, for example, theory of change can be used as the focal point for dialogues with downstream beneficiaries—particularly, owners and employees of investee enterprises and their households, and the communities in which investee businesses operate—to examine intended and unintended, and positive and negative, impacts among these stakeholders.

Tool

The Impact Investing Process

Source: Social Impact Investment Taskforce 2014

Exercise

DFID’s Impact Program is based on an ambitious theory of change that aims to encourage the deployment of impact capital in higher risk contexts and with earlier stage businesses. Watch the video presentation of the DFID theory of change. Form small groups and choose a chair and rapporteur for each group. Each group is asked to answer the following questions: What are some of the key measures of success in this theory of change? What barriers or challenges are likely in collecting data to test this theory of change? What are some effective ways of overcoming those challenges? Record your responses. Your rapporteur will have five minutes to present your group’s ideas to a facilitated plenary.

Readings

Impact Measurement Working Group. Measuring Impact: Subject paper of the Impact Measurement Working Group, G8 Social Impact Investment Task Force, London, 2014. /Measuring-Impact-IMWG-paper.pdf

Jackson, E. Theory of Change, Presented to the Executive Workshop on Impact Investing: Building the Field, Measuring Success, Accra, 2016. http://www.evaluatingimpactinvesting.org/wp-content/uploads/Jackson-Theory-of-Change-Accra-2016.pdf

Jackson, E.T. Interrogating the Theory of Change: Evaluating Impact Investing Where It Matters Most, Journal of Sustainable Finance and Investment, 3(1), 2013, 95-110. Please NOTE: you will need to copy and paste this link to a browser to access it: https://www.tandfonline.com/doi/full/10.1080/20430795.2013.776257

Morra Imas, L. and R. Rist. The Road to Results: Designing and Conducting Effective Development Evaluations, World Bank, Washington, DC, 2009. https://openknowledge.worldbank.org/bitstream/handle/10986/2699/526780PUB0Road101Official0Use0Only1.pdf?sequence=1