Topic

Recent years have seen the beginnings of an ongoing conversation, and steps toward increased mutual understanding, between the fields of development evaluation and impact analysis. With roots in the public sector, and enabled—indeed, demanded—by Northern development agencies, development evaluation as a professional field is powered by national and global associations, national governments, the UN system, accreditation, graduate and executive training programs, journals and conferences. Its orientation is to accountability for public funds, thoroughness and a focus on development results.

For its part, impact measurement as a field of practice has grown out of impact investing, social innovation and social enterprise, and is promoted by the Global Impact Investing Network and its Impact Reporting and Investment Standards system, the Global Impact Investing Rating System, Northern foundations and private fund managers. Where development evaluation has become a mature field, with an older, experienced membership, impact measurement is an early-stage area of practice with younger members, technology-driven tools and more of a private-sector culture. The convergence of these two streams is being animated by practitioners and researchers seeking to build on and blend the strengths of both fields through innovative forms of practice, methods and tools.

Case

From the perspective of the CLEAR Centre for Anglophone Africa, Smith argues that development evaluation offers impact investing in Africa a 50-year track record, a stronger focus on beneficiaries than on investors, better alignment with local and national development goals, a bridge between the public and private sectors, participatory engagement of citizen and civil society, and more rigorous methods and tools for impact evaluation. In South Africa, key policy drivers promoting impact investing and its evaluation include, for example, the Black Business Empowerment Act, the Code of Responsible Investing in South Africa and tripartite-oriented national development frameworks. Two promising sites in that country for blending development evaluation and impact analysis include corporate social investment (CSI) by the mining and retail sectors (although CSI involves grants and not investments per se) and major development finance institutions, including the Development Bank for Southern Africa and the BRICS’ new development bank.

Tool

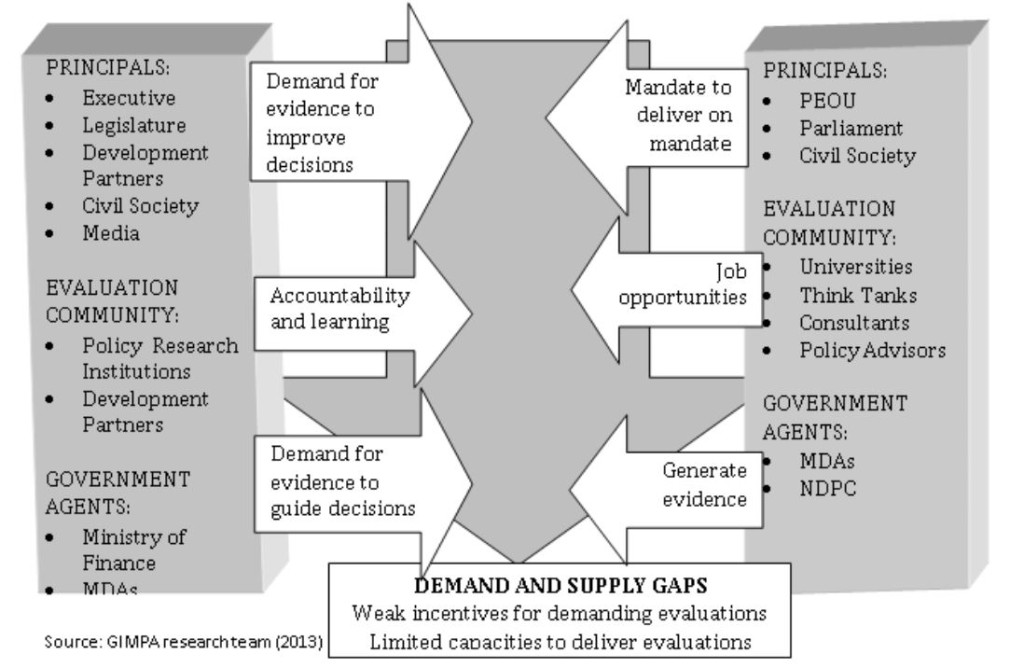

Evaluation Supply and Demand Situation in Ghana

Source: Amoatey 2016, adapted from GIMPA Research Team 2013

Exercise

The graphic above depicts the system of supply and demand for development evaluation generally in Ghana. Form small groups and choose a chair and rapporteur for each. Then answer the following questions in your group: Given that the development evaluation profession is established in that country, how should the impact investing industry prepare development evaluators to become effective M&E specialists in impact investing? Are there new skills, knowledge and tools that these professionals need in order to be of optimum use to the impact investing ecosystem and to individual funds? What is the best way to deliver training to this group of professionals? Record your answers on flip charts or slides. Your rapporteur will have five minutes to present your group’s ideas in a facilitated plenary.

Readings

Amoatey, C. Evaluation in Impact Investing: Ghana, Presentation to the Executive Workshop on Evaluating Impact Investing: Building the Field, Measuring Success, Accra, 2016. Amoatey-Evaluation-Accra-2016.pdf

Evaluation for Africa. Blog, Various Issues, 2016. http://africaevaluation.org/Africa/

Global Impact Investing Network. Assessing Impact Strategy, New York, 2012. see the GIIN website

Harji, K. Getting Serious About Impact, Blog Invited by the Southern African Impact Investing Network, Cape Town and Johannesburg, 2016. https://www.linkedin.com/pulse/getting-serious-impact-karim-harji/

Impact Measurement Working Group. Measuring Impact: Subject paper of the Impact Measurement Working Group, Social Impact Investment Taskforce, London, 2014. Measuring-Impact-IMWG-paper.pdf

Morra Imas, L. and R. Rist. The Road to Results: Designing and Conducting Effective Development Evaluations, World Bank, Washington, DC, 2009. https://openknowledge.worldbank.org/bitstream/handle/10986/2699/526780PUB0Road101Official0Use0Only1.pdf?sequence=1

ODI Methods Lab. What is Impact? Overseas Development Institute, London, February 2016. https://www.odi.org/publications/10326-what-impact

Picciotto, R. The 5th Wave: Social Impact Evaluation, Rockefeller Foundation, New York, 2015. https://www.rockefellerfoundation.org/report/5th-wave-social-impact-evaluation/

Reisman, J. et al. Streams of Social Impact Work: Building bridges in a new evaluation era with market-oriented players at the table, Rockefeller Foundation, New York, 2015. http://orsimpact.com/wp-content/uploads/2015/11/Streams2Rev1Oct.pdf

Smith, L. Evaluating Impact Investing, Presentation to the Executive Workshop on Evaluating Impact Investing: Building the Field, Measuring Success, Accra, 2016. Smith-evaluation-accra-2016.pdf