Topic

Like all investors everywhere, impact investors base their decisions on their analysis of an investment’s projected risk, its expected return—in their case, both social and financial—and, importantly, the provisions offered for exiting the investment. Moreover, an impact investor generally sees it as their duty to preserve their impact mission by selling their units, shares or loan agreements to a buyer that will maintain that same social or environmental mission, often embedding these impact obligations in the investment documents themselves. This is sometimes referred to as mission preservation at exit.

However, what happens when an impact investor is forced, perhaps by a lack of choice among buyers, to sell their investment to a buyer that is not committed to preserving the original mission? This is a real dilemma faced by the holders of maturing impact investments. It is important to note that there is a role here for monitoring and evaluation, both prior to the sale and after it.

Prior to the sale, M&E specialists can gather data that to show the extent to which social or environmental targets are being achieved, the barriers constraining their achievement, the costs of maintaining the mission, and its benefits to the investee, the beneficiaries and the investors themselves. All of this information can be useful in communicating the multi-dimensional value of the mission to prospective buyers.

And in the period following the sale of the investment, assuming the M&E function is maintained, those same specialists can, along with others, help steward the mission through the transition to new ownership of the investment—as well as provide an ongoing stream of information to the new investor. New research has begun to illuminate the nature of, and factors at play in, the exit process in the impact investing industry. This research is shedding light on the role that impact assessment can play in this process, as well.

Tool

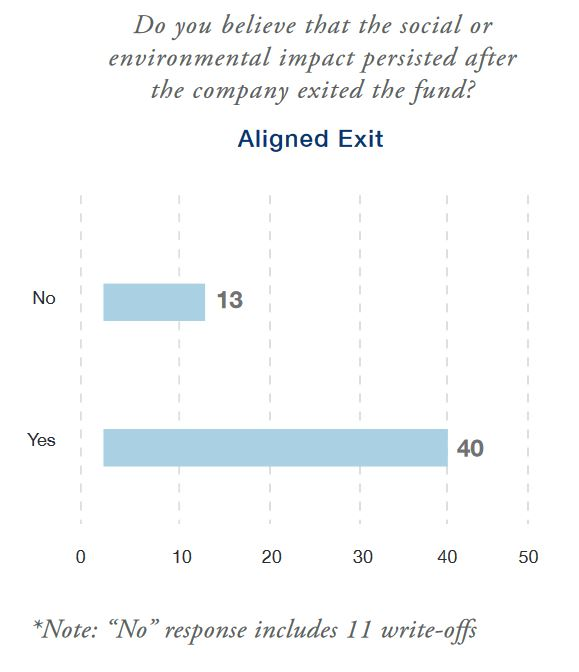

Perceptions of Mission Preservation After Exits (Investor Survey)

Source: Gray et al 2015

Exercise

For ten years, a European development finance institution has held an equity investment in a local water infrastructure company in a cluster of communities in a Southern African country. Along with other DFIs, this investor has been a strong and consistent advocate of the investee company maintaining high standards of water quality in its operations. Now the DFI’s investment has matured and it must exit. The only potential buyer of the investment is a foreign company that is interested in selling water equipment to the local authorities. The prospective buyer is not at all interested in water quality, and in fact has been taken to court in another country for permitting industrial pollution of the water there. The DFI must decide whether to sell to this firm and, if so, under what conditions. Form small groups and choose a chair and rapporteur for each and then develop your answers to the following questions: What is the range of exit options the DFI should explore? What conditions should the seller embed in the purchase agreement? To what extent could the seller use the M&E function to strengthen the mission before and after the sale? Your rapporteur will have five minutes to present your group’s responses in a facilitated plenary.

Readings

Cambridge Associates and the Global Impact Investing Network. Introducing the Impact Investing Benchmark, New York, 2015. https://thegiin.org/assets/documents/pub/Introducing_the_Impact_Investing_Benchmark.pdf

Gray, J., N. Ashburn, H. Douglas and J. Jeffers. Great Expectations: Mission Preservation and Financial Performance in Impact Investing, Wharton Social Impact Initiative, Wharton Business School, University of Pennsylvania; Philadelphia, PA. 2015. https://socialimpact.wharton.upenn.edu/wp-content/uploads/2016/09/Great-Expectations-Mission-Preservation-and-Financial-Performance-in-Impact-Investing.pdf

Impact Terms Project. Website: http://impactterms.org/