Topic

Governments, development agencies and foundations around the world are experimenting with a variety of models that involve the linking of payments to the achievement of results. The monitoring and evaluation of those results are key elements in such models. For example, writing with reference to US foreign assistance, Savedoff et al highlight an approach called “Cash on Delivery (COD) Aid,” which “offers a fixed payment to recipient governments for each additional unit of progress toward a commonly agreed-upon goal (e.g., $200 for each additional child who completes primary school and takes a standardized test).” In this model, the outcome measures or units of progress are negotiated and embedded in the aid agreement, and are independently verified at regular intervals.

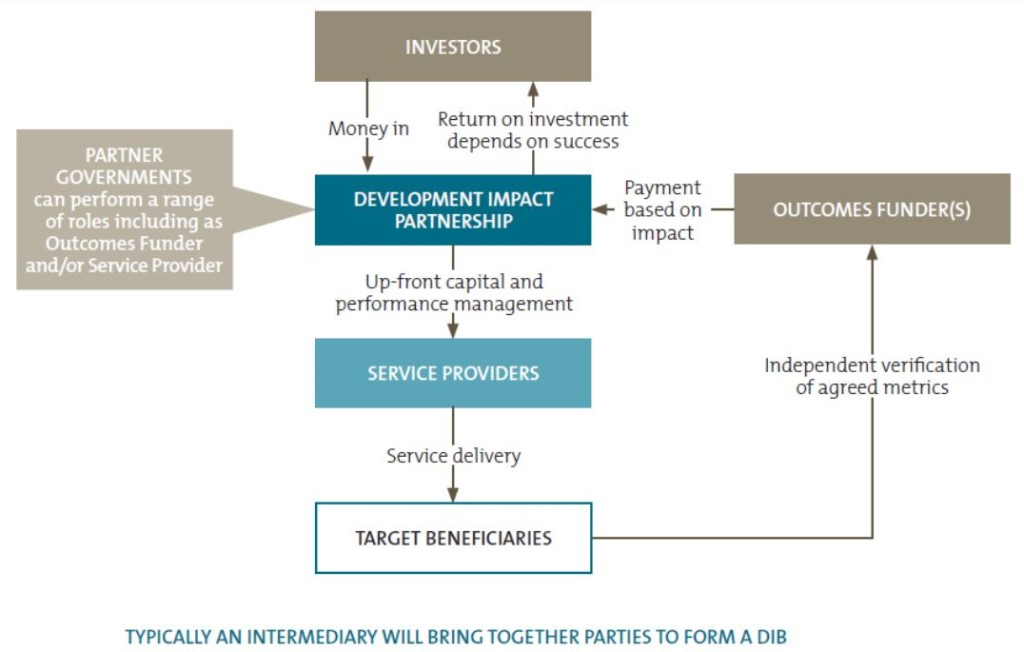

Another approach that has been the subject of considerable experimentation and debate in the developed economies is that of the social impact bond (SIB), also sometimes called a social benefit bond or social performance bond. Its developing-economy analogue is the development impact bond (DIB). In fact, these are not bonds in the technical sense of that term; rather, they are actually pay-for-success, or pay-for-results, contracts. In a development impact bond (as in a SIB), the capital of private impact investors is mobilized through a partnership structure to fund a social program that is implemented by a non-governmental organization or private company. Development agencies, foundations and the government de-risk these deals through first-loss provisions or other enhancements, and may act as co-investors. The parties to the DIB sign on to achieve certain outcome targets. If these targets are achieved through the implementation process, the investors receive their principal capital as well as an attractive financial return. But if the targets are not achieved, the investors do not receive their financial return and may even lose some of their principal, depending on the arrangement.

The achievement of outcomes is verified and reported on by independent evaluators. In some cases of SIBs, evaluation teams have employed quasi-experimental design with control groups. An early DIB experiment was created in Mozambique to fight malaria in a community where mine workers live. The Bertha Centre at the Graduate School of Business in Cape Town hosts a unit specializing in impact bonds that carries out research and advises the public and private sectors on the application of the SIB/DIB model in South Africa and elsewhere on the continent to other health issues, reconciliatory justice and early childhood education, among other areas.

However, DIBs (like SIBs) are specialized, small-scale, micro-oriented and labour-intensive in both their design and execution, and therefore appeal to a limited pool of stakeholders. Moreover, these mechanisms can be hampered by the unrealistic results expectations set by proponents in order to attract investors. Nonetheless, they constitute a creative tool for generating targeted social results and their application can spur progress at the local level under the appropriate conditions.

Tool

Structure of a Development Impact Bond

Source: Savekoff et al 2015

Exercise

One of Africa’s first DIBs, the Mozambique Malaria Performance Bond, involved a $25 million pay-for-success contract that provided impact investors with a 5% return if malaria were reduced by 30% in a pilot area of Maputo province where mine workers were falling sick to the disease. If the target was not achieved, investors would receive only 50% of their principal and no interest. Risks and returns were shared by Nando’s, Anglo American, the Coca-Cola Foundation, Dalberg and the Ministry of Health. Form small groups and choose a chair and rapporteur for each. Your group has been asked to design a similar development impact bond to fight malaria in a district with mining communities in your country. What are the key factors you must address in the design with respect to each of the stakeholder groups involved? How do you decide what terms to offer the investors? What methods should be used to monitor and evaluate the results of this DIB? Record your responses on a flip chart or slides. Your rapporteur will be given five minutes to present your group’s ideas in a facilitated plenary.

Readings

Beck, L., C. Schwab and A. Pinedo. Social Impact Bonds: What’s in a Name? Stanford Social Innovation Review, October 10, 2016. https://ssir.org/articles/entry/social_impact_bonds_whats_in_a_name

Bertha Centre. Social Impact Bonds Could Boost Development and Jobs, Graduate School of Business, University of Cape Town, 2014. http://www.gsb.uct.ac.za/s.asp?p=530

Drew, R. and P. Clist. Evaluating Development Impact Bonds: A Study for DFID, DFID, 2015. https://assets.publishing.service.gov.uk/media/57a0896b40f0b64974000092/DIB_Study_Final_Report.pdf

Gungadurdoss, A. Lessons from a Development Impact Bond, Stanford Social Impact Review, August 2016: http://ssir.org/articles/entry/lessons_from_a_development_impact_bond

Han, L. Malaria in Mozambique: trialling payment by results, The Guardian, Washington, DC, March 31, 2014. https://www.theguardian.com/global-development-professionals-network/2014/mar/31/malaria-control-payment-by-results

Patton, A. Impact bonds in Africa–a whole different story, Inside Out, 2013. http://insideoutpaper.org/impact-bonds-in-africa/

Rosenberg, T. An Investment Strategy in the Human Interest, The New York Times, June 19, 2013. http://opinionator.blogs.nytimes.com/2013/06/19/an-investment-strategy-in-the-human-interest/?_r=0

Savedoff, W., R. Perakis and B. Schwanke. Shifting the Foreign Aid Paradigm–Paying for Outcomes, Center for Global Development, Washington, DC, 2015. http://www.cgdev.org/publication/ft/shifting-foreign-aid-paradigm-paying-outcomes