Topic

Gender equality is a deeply held value among many development organizations, African and foreign. Here the concept may also refer to equality in terms of gender identity, particularly among LGBT persons. To be sure, the ideas and practices around gender equality, and their advocates and opponents, vary widely across the African continent.

Overall, the impact investing industry has been slow to devote serious attention to the issue of gender equality in its practices. One exception in this regard, though, is the field of microfinance, where a range of organizations—from women-run non-profits such as Shared Interest and Thembani in South Africa to global initiatives like the Consultative Group to Assist the Poorest and Women’s World Banking—have illuminated the barriers and innovations in lending to women micro-entrepreneurs.

Another exception is the work of the Criterion Institute and its allies on gender lens investing. “At its core,” a recent Institute study states, “gender lens investing incorporates a gender analysis into financial analysis in order to get to better outcomes. Through the creation of financial products and vehicles that reflect an understanding of the gendered nature of our world, innovators within the field of gender lens investing have created a new set of investment opportunities.” Three prime areas of focus for this approach are access to capital for women, workplace equity, and products and services that enhance the well-being of women.

Still another notable exception is Root Capital, a US-based non-profit impact investment fund that has loaned nearly $800 million to 500 farmer’s organizations worldwide in the space it calls the “missing middle” of development finance—working capital facilities that are too large for microfinance institutions to provide but too small for commercial banks—often securing its loans with the inventories of its borrowers.

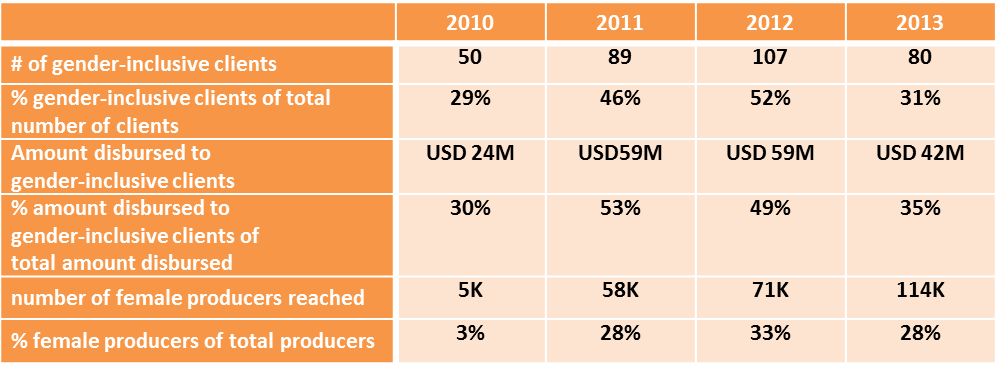

With the support of a feminist investor, Root Capital has placed a gender lens over its entire portfolio and now tracks a set of gender-inclusive indicators. In the process, the organization has initiated an action research program on the role of women as “hidden influencers” in the agricultural value chain. In general, development evaluators and impact analysts can and should combine forces to promote the integration of a gender-equality perspective in the practice of evaluating impact investing.

Moreover, some gender issues require separate treatment and analysis. There is an array of resources to tap for this work, including EvalGender, a coalition of multilateral agencies and evaluation associations promoting the demand, supply and use of equity-focused and gender-responsive evaluations. It is crucial that evaluations in the impact investing space collect and analyze gender-disaggregated data, remaining alert to different patterns of results across women and men, and embed gender analysis across all aspects of the evaluation design.

Tools

Three Lenses for Promoting Gender Equality

Source: Anderson and Miles 2015

Root Capital Gender Outcome Metrics

Source: Root Capital 2014

Exercise

Root Capital works invests in dozens of investee associations and cooperatives in agriculture sector in Africa. The organization wishes to carry out a comparative study of the downstream results of its gender-inclusive versus non-gender inclusive clients. Its hypothesis is that there will be stronger indicators of improved well-being in the households of female producers than in the households of male producers and that those effects will be especially strong in the households of female producers in gender-inclusive client organizations. This hypothesis is based on research from microfinance and development economics suggesting that women are more committed than men to directing new household revenue into increased access to education, health and nutrition for their children and adult family members. Form small groups and choose a chair and rapporteur. Your group has been asked to advise Root Capital on the design of this study and to use both qualitative and quantitative methods. The study will be paid for by a local foundation in concert with a foreign development agency. Please record your answers to the following questions: 1) What are the key factors to consider in designing this study? 2) What methods and tools could be used? 3) How should Root Capital use the findings and recommendations of the study? Your rapporteur will have five minutes to present your group’s ideas in a facilitated plenary session.

Readings

Anderson, J. and K. Miles. The State of the Field of Gender Lens Investing, Criterion Institute, 2015. http://criterioninstitute.org/wp-content/uploads/2012/06/State-of-the-Field-of-Gender-Lens-Investing-11-24-2015.pdf

EvalGender. Website: http://www.evalpartners.org/evalgender

Hull, K. Investing in Women, Stanford Social Innovation Review, October 7, 2015. http://ssir.org/articles/entry/investing_in_women

Iskenderian, M. E. Prove It: Measuring Gender Performance in Microfinance, CGAP Blog Series, October 3, 2013. http://www.cgap.org/blog/prove-it-measuring-gender-performance-microfinance

Katzin, D. Shared Interest: Loan Guarantees—and System Change—for Women in South Africa, ImpactAlpha, March 8, 2016. http://impactalpha.com/shared-interest-loan-guarantees-and-system-change-for-women-in-south-africa/

Napier, M., C. Melamed, G. Taylor and T. Jaeggi. Promoting women’s financial inclusion: A toolkit, DFID, GIZ, 2013. https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/213907/promoting-womens-financial-inclusion-toolkit.pdf

Rogers, K. When gender data became cool, Devex, August 9, 2016. https://www.devex.com/news/when-gender-data-became-cool-88548

Root Capital. Applying a Gender Lens in Agriculture, Cambridge, Mass., 2014. https://rootcapital.org/wp-content/uploads/2018/01/Root_Capital_Gender_Lens_Issue_Brief_v2.pdf

Women’s World Banking. Gender Performance Indicators, Washington, DC, 2013. http://www.womensworldbanking.org/wp-content/uploads/2013/09/Womens-World-Banking-Gender-Performance-Indicators.pdf