Topic

There is a cost to evaluating impact investing. Who should pay for it? How is it valued? In development evaluation in Africa, aid agencies and governments—the public sector—have been the main funders of evaluation and monitoring systems, consultant studies, and some evaluation associations. In impact investing, impact investment funds themselves typically provide money in their core business models to cover the costs of front-end evaluation, known as due diligence, monitoring and reporting on key output indicators (investee financial performance, jobs created, etc.) and social impact stories of selected investee firms, entrepreneurs or communities.

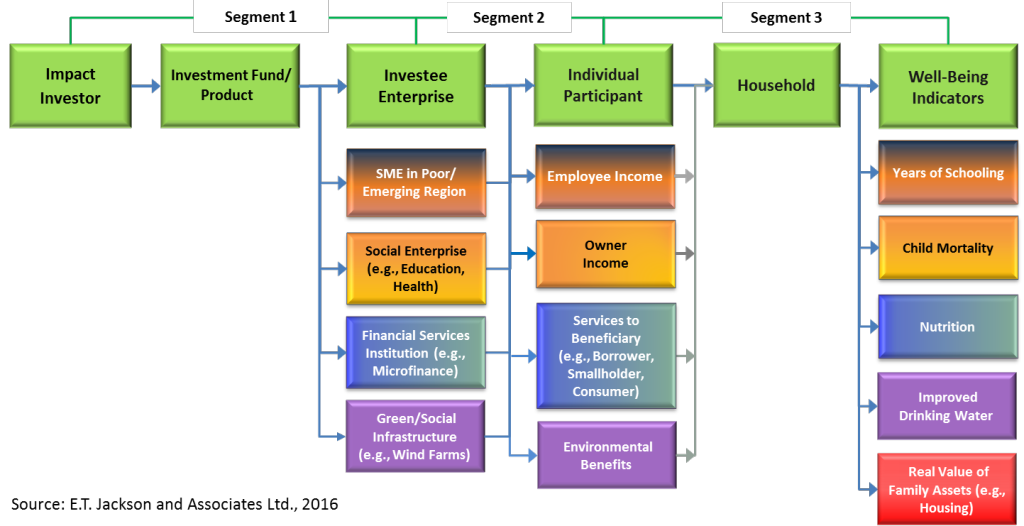

However, there are limits to the M&E costs that small (or even large) funds can cover. Further, impact investors often require their investees to collect data on core metrics on a quarterly or annual basis. But investees must devote the bulk of their time to making their businesses successful, and that is challenging enough. Still further along the results chain are the households of beneficiaries: employees and customers of investee companies, and members of the communities in which investees are located. The costs of detailed micro-level studies of the effects of impact investments on these households can rarely be incorporated into the business models of either funds or investees. Such studies require substantial, stand-alone grant funds.

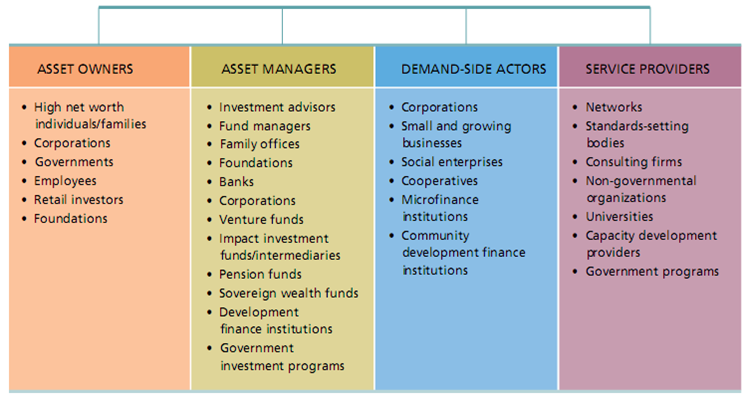

Among the actors in the impact investing ecosystem whose financial resources should be mobilized to pay for more systematic studies at this point on the results chain, and on other points, as well, are development agencies, governments, non-governmental organizations, charitable foundations, development finance institutions, banks, pension funds and major corporations.

Each national ecosystem must find an appropriate solution to paying for the costs of evaluating impact investing funds and vehicles, investees and affected households. Further, in order to optimize the benefits of this funding, industry leaders must ensure that the findings of all evaluations are fed back, in transparent and timely fashion, into the ecosystem in order to strengthen the effectiveness of all actors in the field.

Finally, for all evaluation and monitoring strategies and methods, this is an exciting moment in which to mobilize innovative information and communication technologies to achieve cost efficiencies and novel functionality at the same time. Visualization, mobile-phone data collection, micro-narrative applications and intelligent infrastructure—the possibilities are growing every day.

Tools

Impact Investing Ecosystem

Source: Harji and Jackson 2012

Impact Investing Results Chain

Source: E.T. Jackson and Associates Ltd. 2016

Exercise

Form small groups and choose a chair and rapporteur for each. Your group task is the following: You represent a group of impact investment funds that have come to the realization that more detailed and systematic evaluation of the results of their investments is required. The group of funds proposes, first, a series of organizational assessments of successful and unsuccessful investee firms in a sample of sectors (e.g., agriculture, clean energy, etc.) and, second, annual household impact evaluations in a sample of poor regions where investee companies employ workers and sell products and services. Your team is planning a presentation to secure funding commitments for these studies. You are presenting to senior officials from two bilateral development agencies and their development finance institution, your country’s ministry of industry and its main development finance institution, a foreign foundation, a major national bank, a public pension fund, and a coalition of local NGOs. Please answer the following questions: What benefits flowing from these proposed evaluations will you emphasize in your presentation? What objections do you expect to hear from your audience, and how will you respond to those objections? Record your responses on flip charts or slides. You have 30 minutes for this task. Your rapporteur will have five minutes to present your group’s ideas in a facilitated plenary.

Readings

Dichter, S., T. Adams and A. Ebrahim. The Power of Lean Data, Stanford Social Innovation Review, Winter 2016, 36-41. http://ssir.org/articles/entry/the_power_of_lean_data

Edens, G. and S. Lall. State of Measurement Practice in the SGB Sector, Aspen Network of Development Enterprises (ANDE), 2014. https://www.aspeninstitute.org/wp-content/uploads/files/content/docs/pubs/The%20State%20of%20Measurement%20Practice%20in%20the%20SGB%20Sector.pdf

Raftree, L. Benefits, barriers and tips for ICT-enabled M&E, April 2013, Website: http://lindaraftree.com/2013/04/17/benefits-barriers-and-tips-for-ict-enabled-me/

Raftree, L. and M. Bamberger. Emerging Opportunities: Monitoring and Evaluation in a Tech-Enabled World, ITAD and the Rockefeller Foundation, 2014. https://www.rockefellerfoundation.org/wp-content/uploads/Monitoring-and-Evaluation-in-a-Tech-Enabled-World.pdf/

Schiff, H., R. Bass and A. Cohen. The Business Value of Impact Measurement, GIIN Issue Brief, GIIN, 2016. https://thegiin.org/assets/GIIN_ImpactMeasurementReport_webfile.pdf

United Nations Development Programme. Innovations in Monitoring & Evaluating Results, Knowledge, Innovation and Capacity Group, New York, 2013. https://etjackson.com/Discussion-Paper-Innovations-in-Monitoring-Evaluating-Results.pdf