Topic

One of the key challenges, and opportunities, for expanding impact investing in Africa relates to finding effective ways of mobilizing the capital of institutional investors. Pension funds, in particular, have very specific requirements: generally, they seek to place their capital in large-scale, long-term, often less risky investments with clear exit pathways. This is true for pension funds based in the Global North and it is also for those based in Africa.

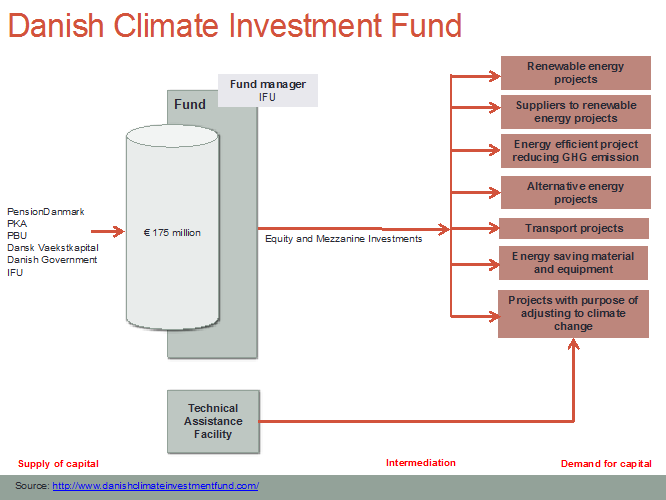

In terms of Northern institutions, one vehicle that has succeeded in this regard is the Danish Climate Investment Fund. Spurred by the participation of Denmark’s aid program and managed by its development finance institution, this fund raised more than $220 million from public and private pension funds in Denmark for major clean energy and climatechange adjustment projects involving Danish companies, like the Lake Turkana Wind Farm in Kenya and wind and solar farms elsewhere on the continent. Investing in other parts of the developing world, this fund offers its institutional investors a 12% annual rate of return over its ten-year life-cycle.

In another notable example, the New York State Common Retirement Fund plans to invest $5 billion over the next five years in private equity funds and fund of fund vehicles focused on energy projects in Africa, encouraged by the US Department of Labor’s recent guidance on economically targeted investments.

In Africa itself, South Africa’s largest pension fund, the Public Investment Corporation, invested about $80 million to buy 20% stakes in two solar power stations in Northern Cape Province; together, these stations will add 200 megawatts of electricity to the national grid. In addition, South Africa’s Metal Industries Benefit Funds Administrators committed up to R1 billion to invest in clean energy. The National Union of Mineworkers supported this decision but called for local-content requirements in sourcing equipment for the construction of green energy plants and associated civil works.

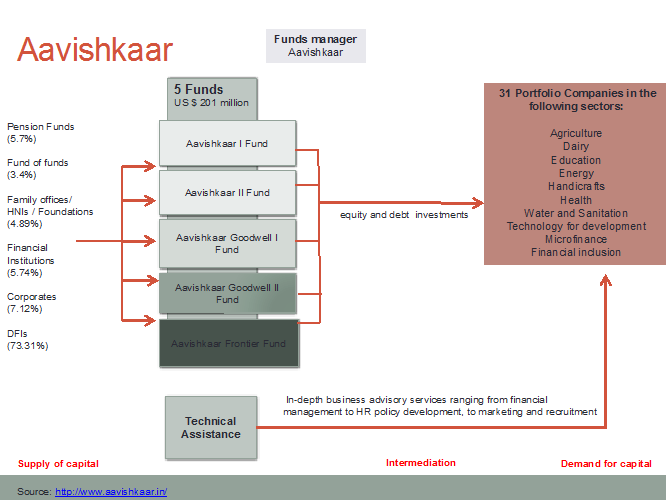

Outside of the green energy sector, for a decade, Northern institutional investors have placed capital in a series of microfinance funds run by the Dutch group ACTIAM, that in turn invest in microfinance institutions in Eastern Europe, Asia and the Americas. In Australia, supported by a first-loss provision by the national government, the non-profit pension fund, Christian Super, made an AUS $6 million equity investment the Community Finance Fund that finances social enterprises. A final case is that of Aavishkaar, an Indian-owned private equity fund that invests in early stage and growth businesses in Asia, and whose diverse group of investors include pension funds.

Source: Koenig and Jackson 2016

Source: Koenig and Jackson 2016

Exercise

In your country, the public sector pension fund for government employees has large assets and is a major force in the national economy. Generally speaking, it has been a risk-averse investor, comfortable with large-scale infrastructure investments, housing projects and other real estate initiatives. They favour co-investing with other investors and prefer investments of $10-20 million in size over ten years, yielding above market rates of return. Form small groups, choosing a chair and rapporteur. Your group has been tasked to make a presentation to the public sector pension fund to convince them to allocate up to 5% of their assets to investments that generate social and environmental benefits as well as stable financial returns. Three sectors of interest to the pension fund are renewable energy, affordable housing, and water and sanitation systems. How should you approach this presentation? What will you emphasize? What opposition to your pitch do you anticipate and how will you address it? Record your responses on flip charts or slides. Your rapporteur will have five minutes to present your group’s ideas in a facilitated plenary.

Readings

ACTIAM. Institutional Microfinance Fund III, 2014. http://www.actiam.nl/nl/documenten/fondsen/Documents/impact-investing-fondsen/Factsheet_AIMF_III.pdf

Bakewell, S. and M. Carr. Danish Pension Fund to Invest in Renewable Energy Projects in Developing Nations, Renewable Energy World website, January 13, 2014. http://www.renewableenergyworld.com/news/2014/01/danish-pension-fund-to-invest-in-renewable-energy-projects-in-developing-nations.html

Bouri, A. and A. Mudaliar. Catalytic First-Loss Capital, Issue Brief, Global Impact Investing Network, New York, 2013. http://www.thegiin.org/assets/documents/pub/CatalyticFirstLossCapital.pdf

Bridges Ventures. Shifting the Lens: A De-risking Toolkit for Impact Investment, Bridges & Bank of America Merrill Lynch, 2014. https://thegiin.org/knowledge/publication/shifting-the-lens-a-de-risking-toolkit-for-impact-investment

Clark, S. New York Pension Fund to Invest Billions in Africa, The Wall Street Journal, April 29, 2015. http://www.wsj.com/articles/new-york-pension-fund-to-invest-billions-in-africa-1430298385

Convergence Finance. Case Study:Danish Climate Investment Fund, September 2017. https://assets.contentful.com/bbfdx7vx8x8r/6k1qcMaQNy0UEW0yU8ciCg/a62199d2891d370c8469e6c506c8b938/Convergence__Danish_Climate_Investment_Fund_Case_Study__2017.pdf

Department of Labor. Interpretive Bulletin Relating to the Fiduciary Standard under ERISA in Considering Economically Targeted Investments, Washington, DC, 2015. https://s3.amazonaws.com/public-inspection.federalregister.gov/2015-27146.pdf

Motsoeneng, T. South Africa pension fund invests $81 m in two solar power projects, Reuters Africa, March 18, 2015. https://af.reuters.com/article/investingNews/idAFKBN0ME0VK20150318

Social Impact Investment Taskforce. Allocating for Impact: Subject Paper of the Asset Allocation Working Group, 2014. http://www.bridgesfundmanagement.com/wp-content/uploads/2017/08/Allocating-for-Impact-Subject-Paper-of-the-Asset-Allocation-Working-Group.pdf

World Economic Forum and Organization for Economic Cooperation and Development. Blended Finance Vol. 1: A Primer for Development Finance and Philanthropic Funders, An overview of the strategic use of development finance and philanthropic funds to mobilize private capital for development, ReDesigning Development Finance Initiative, Geneva and Paris, 2015. http://www3.weforum.org/docs/WEF_Blended_Finance_A_Primer_Development_Finance_Philanthropic_Funders_report_2015.pdf

World Economic Forum. From the Margins to the Mainstream: Assessment of the Impact Investment Sector and Opportunities to Engage Mainstream Investors, Geneva, 2013. http://reports.weforum.org/impact-investment/