Topic

As the impact investing sector begins to develop more sophisticated approaches to impact measurement, sector-based approaches have been gaining traction. Sector-based approaches are grounded in a specific sector or issue area—such as sustainable agriculture, primary healthcare, secondary education, etc.—and have provided impact investors with common outcome measures, more readily available tools and approaches, and comparable data and benchmarking potential, among other advantages. As such, organizations and networks are beginning to work collectively in specific sectors.

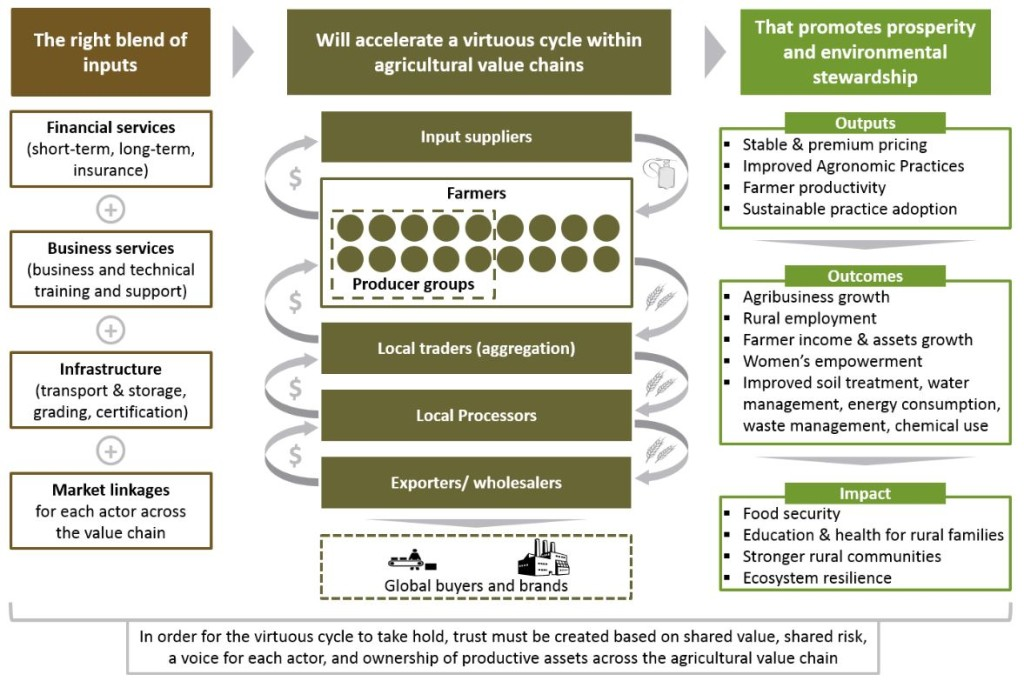

One example is in the area of sustainable agriculture, and specifically working with smallholder farmers. This is particularly relevant to the African context, since a substantial proportion of the population continues to be directly and/or indirectly engaged in agriculture. As the Initiative for Smallholder Finance publication explains, impact measurement for this sector should include the key elements in the theory of change of the intervention, with the application of assessment tools varying by objectives, context and region.

Theory of Change – Smallholder Agricultural Finance

Source: Fonzi and Chau 2014

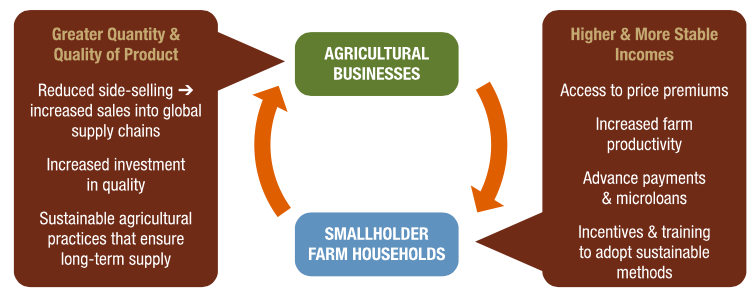

Root Capital has been a pioneer in this area, and has produced a series of publications that unpack their approach to impact measurement, in order to demonstrate how their financial and mission/impact interests align in practice. They focus on measuring how agricultural businesses support producer livelihoods and ecosystems through five key indicators: Increasing prices to producers and wages to employees ; Increasing producer productivity; Increasing stability of producer income; Investing in or linking producers with public goods (e.g., health, education, water, transportation); and Creating the incentives and delivering the training required to sustain producers’ ecosystems (Root Capital, 2014a).

Root Capital – The Mutually Beneficial Cycle

Source: Root Capital 2014b

In addition to making the “business case” for impact measurement, they provide their methodology guide and social and environmental scorecards, which all work together to create an effective system that balancing impact assessment and performance management. As they note, “For financial institutions motivated by profit, by impact, or by both, social and environmental due diligence processes that strike a reasonable balance between efficiency and rigor can be introduced at modest incremental cost and with a potentially significant financial benefit that complements the intrinsic social and environmental benefits.” (Root Capital, 2014a). They found that integrating social and environmental considerations into borrower due diligence has improved their financial results in five ways: identifying credit risks; generating new business; identifying businesses with growth potential; strengthening clients’ business; and growing business with existing clients (2014a).

Tools

Root Capital has constructed a comprehensive social and environmental scorecard that they use for their borrowers (see Root Capital, 2015). Social due diligence criteria include: Scale (number of people reached); Enterprise Access to Finance (including assessing additionality); Producer Context (including income level, sales, food security); Services to Producers & Employees (including payments, wages and benefits, health and safety, credit, community programs, gender inclusivity); and a Qualitative Assessment of Producer and Employee-level Impact.

Exercise

Review the case study on Fruiteq in Burkina Faso, authored by Root Capital. In small groups, discuss each of the questions below, and summarize your key points for a presentation to the larger group:

- In the section on “Root Capital’s impact on Fruiteq”: Pick one output and one outcome measure that you think is the best proxy for this section. Explain why you picked this one, and whether in fact it is a good proxy for the other outputs and outcomes noted in this section. What information is missing? What assumptions were made in linking outputs and outcomes?

- In the section on “Fruiteq and UPPFL’s Impact on Farmers”: Pick one output and one outcome measure that you think is the best proxy for this section. Explain why you picked this one, and whether in fact it is a good proxy for the other outputs and outcomes noted in this section. What information is missing? What assumptions were made in linking outputs and outcomes?

- In the section on “Livelihood Impacts”: Pick one output and one outcome measure that you think is the best proxy for this section. Explain why you picked this one, and whether in fact it is a good proxy for the other outputs and outcomes noted in this section. What information is missing? What assumptions were made in linking outputs and outcomes?

- In the section on “Fruiteq’s Impact on the Community”: Pick one output and one outcome measure that you think is the best proxy for this section. Explain why you picked this one, and whether in fact it is a good proxy for the other outputs and outcomes noted in this section. What information is missing? What assumptions were made in linking outputs and outcomes?

Readings

Fonzi, C.J. and V. Chau. Smallholder Impact and Risk Metrics: A Labyrinth of Opportunity, Briefing 03, Initiative for Smallholder Finance, March 27, 2014. https://www.raflearning.org/post/smallholder-impact-and-risk-metrics-labyrinth-opportunity-1

Root Capital. Fruiteq – Burkina Faso, Rapid Impact Evaluation, Root Capital, Cambridge, 2013. https://rootcapital.org/wp-content/uploads/2018/01/root_capital_fruiteq.pdf

Root Capital. Social & Environmental Due Diligence: From the Impact Case to the Business Case, Issue Brief #1, Root Capital, Cambridge, 2014a. https://growthorientedsustainableentrepreneurship.files.wordpress.com/2016/07/en-social-and-environmental-due-diligence.pdf

Root Capital. Social & Environmental Due Diligence: Detailed Methodology Guide and Initial Results, Root Capital, Cambridge, 2014b. https://rootcapital.org/wp-content/uploads/2018/01/Social_and_Environmental_Scorecards_ENG.pdf

Root Capital. Social and Environmental Scorecards, Root Capital, Cambridge, 2015. https://rootcapital.org/wp-content/uploads/2018/01/Social_and_Environmental_Scorecards_ENG.pdf